Heartwarming Tips About How To Choose Savings Account

To open a savings account, you’ll need to complete an account application and provide proof of identity and your address.

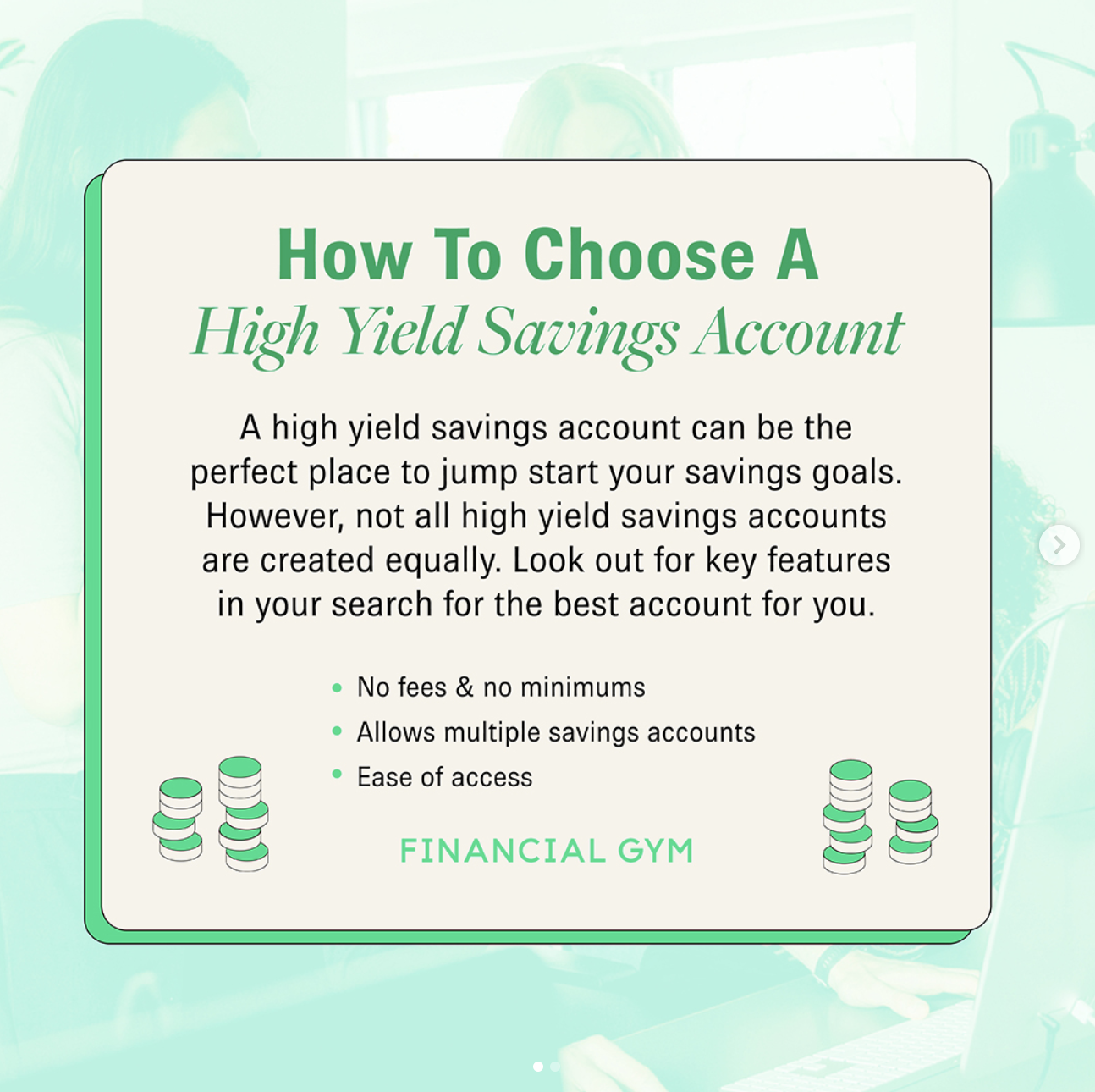

How to choose savings account. For best results, choose a savings account that doesn’t have a monthly maintenance fee. You can look up and compare interest rates by visiting the websites of several banks or credit unions. The first place to look for a savings account is your current bank.

Many institutions allow you to complete this. Learn the benefits of the de529 education savings plan Choosing the best savings account starts with comparing interest rates.

The national average is typically around.1% apy according to the fdic. First, determine how you want to use the money you're saving. Loginask is here to help you access where to open savings account quickly and.

Grow your savings with the most competitive rates. A dividend rate of 0.05% will be paid on the. The interest rate is usually the deciding factor when choosing a savings account because it will determine how much your savings will grow over time, which is the main point of having a.

Like any checking or savings account. Ad help your family save for college. Until then, a parent, legal guardian or grandparent, can open a custodial account on their behalf.

So a $10,000 balance with an interest rate of.1% apy will only earn $10 each year. Most banks generally require that account holders be at least 18 years old. Instead of keeping all of her money in a traditional checking or savings account, jefferson opened a money market account, or mma,.

:max_bytes(150000):strip_icc()/checking-vs-savings-accounts-4783514-ADD-V3-8bb1de3ef0a848e0bd7b65ef146ab924.jpg)

![Choosing A Savings Account [Infographics]](https://moneyning.com/wp-content/uploads/2010/10/choosing-savings-accounts-full.jpg)

/why-would-you-keep-funds-money-market-account-and-not-savings-account-ADD-Color-V3-e17a68d37eb9437eba385eb0c6452f49.jpg)