Neat Info About How To Check Status On Tax Return

Their social security number or individual taxpayer identification number.

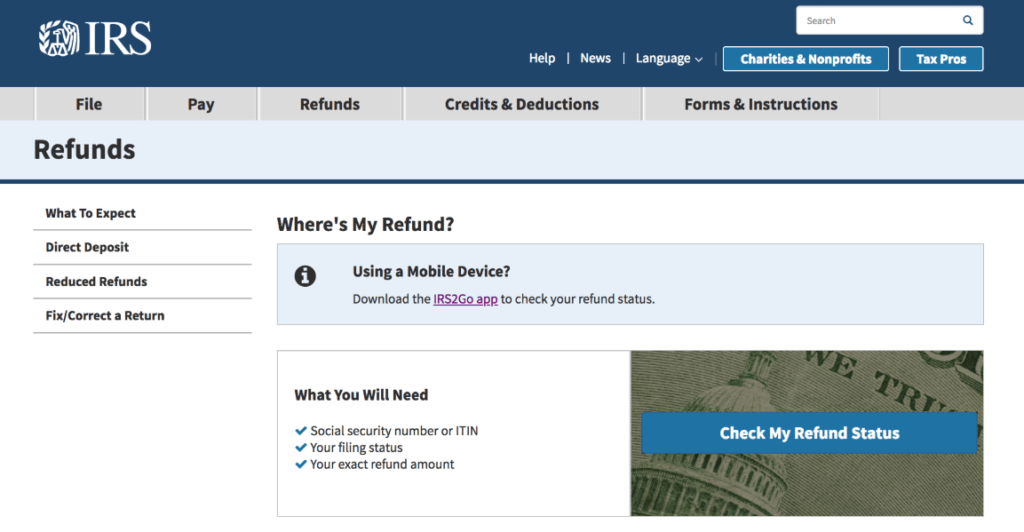

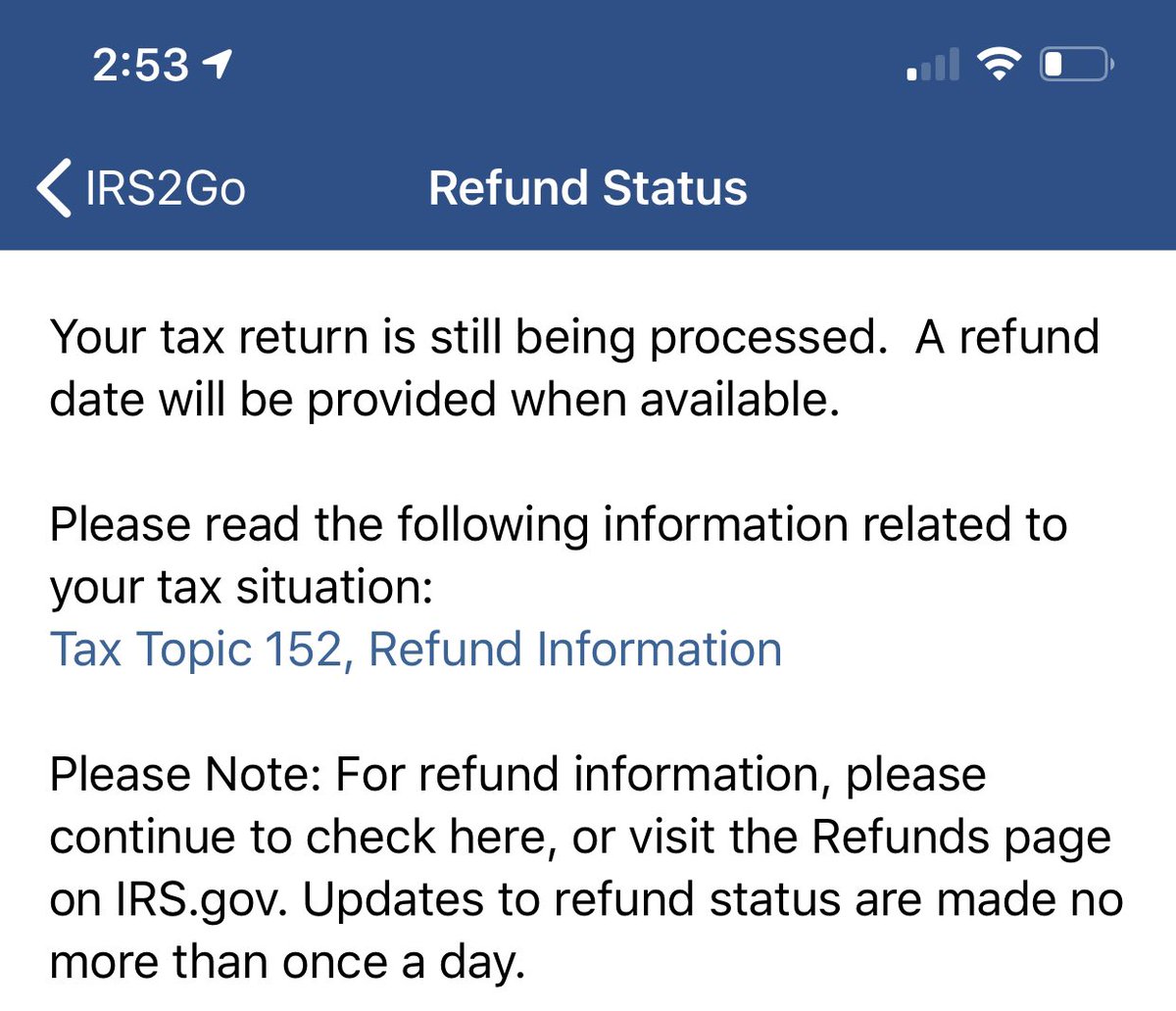

How to check status on tax return. Using the irs where’s my refund tool viewing your irs account information. When the status changes to approved, it means the irs is preparing to. Your social security number (ssn) or individual taxpayer.

From the home page select manage tax returns; $1,563 with an income of $250,000; Fields marked with * are required.

All you need is internet access and this information: Whether you owe taxes or you’re expecting a refund, you can find out your tax return’s status by: Their social security number or individual taxpayer identification number.

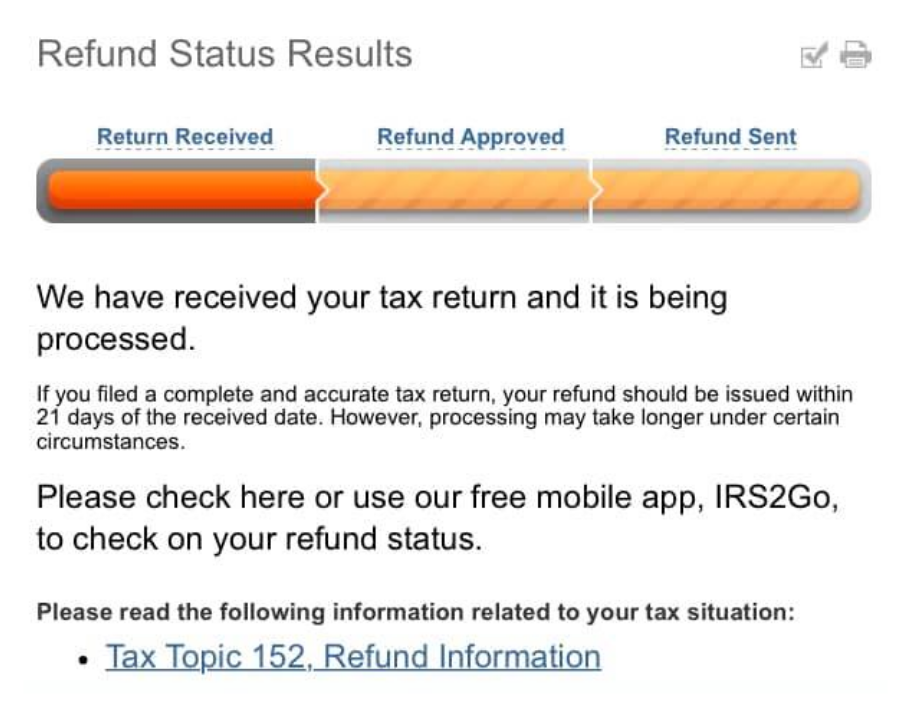

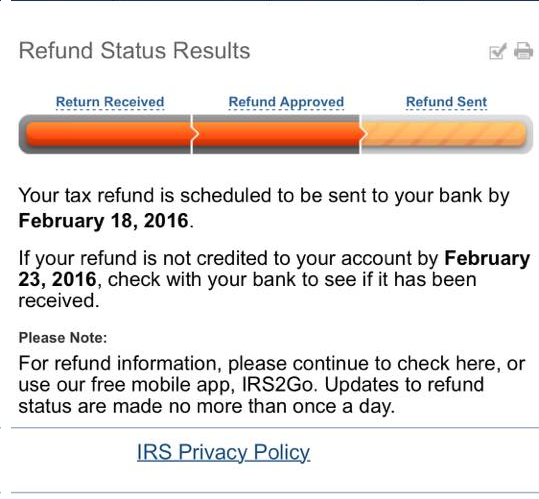

It will tell the taxpayer when their return is in received status and if the refund is in approved or sent status. Banks typically reject tax refunds due to a wrong account number or routing number on the recipient’s tax return. 20 hours agofor additional information or to check on the status of a rebate, visit tax.illinois.gov/rebates.

To view refund/ demand status, please follow the below steps: To enable credit of refund directly to the bank account, taxpayer's bank a/c, micr code/ifsc code of bank branch and correct communication address is mandatory. March 5, 2019 the best way to check the status your refund is through where's my refund?

Check in this order on this page detailing your refund status: To use the tool, taxpayers will need: Tax year of the refund;