Fine Beautiful Tips About How To Buy A Call Option

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

You find a stock (or etf) you would like to buy.

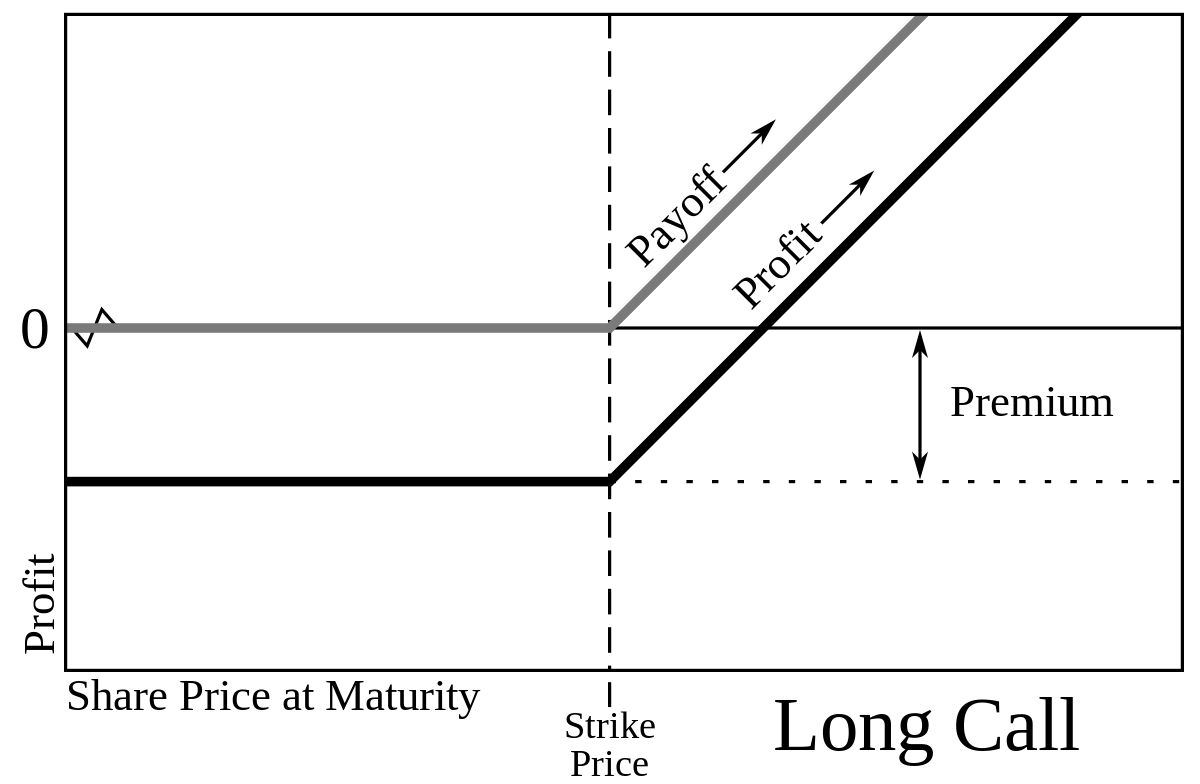

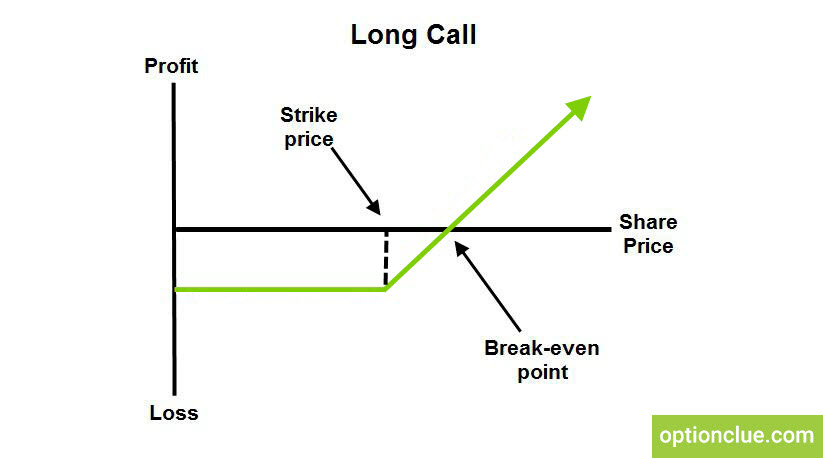

How to buy a call option. When you’re buying a call, it means you’re looking f. I start with a sample trade, and g. Let’s take a look at the risk profile picture of buying a call.

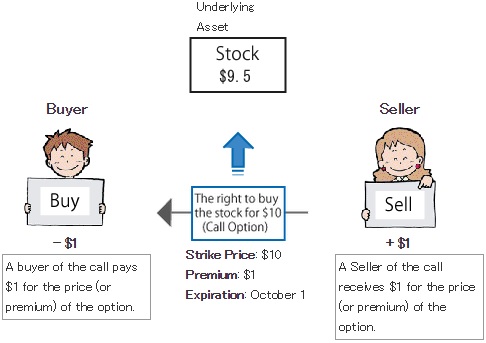

$50 x 100 shares = $5,000; Here’s how to buy call options: What is a call option?you might have heard about option contracts in the past.

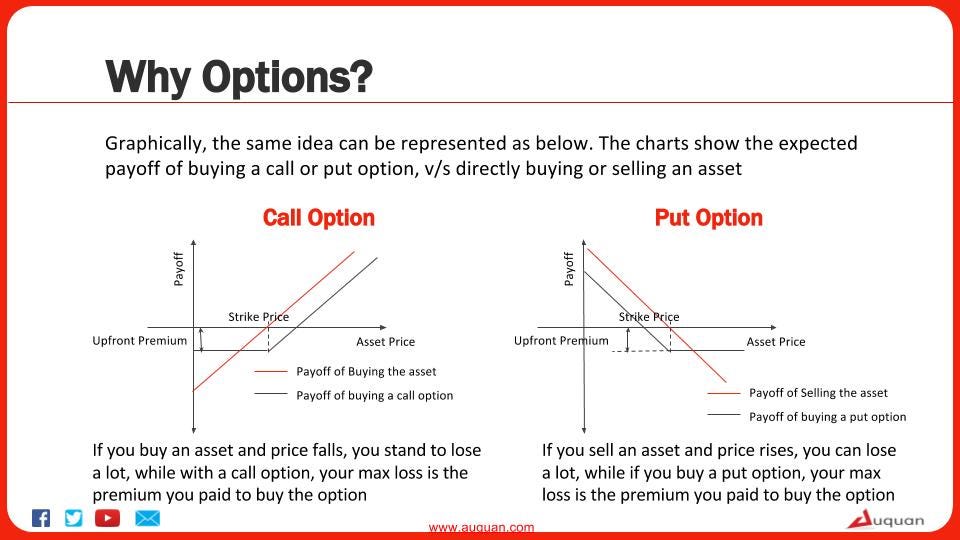

You can find options tables online or through your. First off you have to decide where do i want to buy a call option. Calls give the buyer the right, but not the obligation, to buy the underlying asset at the strike price.

It gives you a right to. Buying a call option entitles the buyer of the option the right to purchase the underlying futures contract at the strike price any time before the contract expires. If you’re just buying a call,.

Look for high open interest. There are calls and puts. That is exactly how you buy a call option on any broker platform.

Ad all the trading tools you need to quickly place your trades into the market. The two most common types of options are calls and puts: Read options tables to find potentially profitable options to buy.

:max_bytes(150000):strip_icc()/BeginnersGuidetoCallBuying-6d00c8bc193a43b6b45c6347f2bd50d1.png)

![How To Buy A Call Option - [Option Trading Basics] - Youtube](https://i.ytimg.com/vi/fUNk8TjrZOA/maxresdefault.jpg)